[ad_1]

The European Central Financial institution is unlikely to step immediately into foreign-exchange markets even within the face of a greater than 10% droop within the euro this yr, though there’s potential for Japan to have interaction in that type of intervention if the yen continues to unravel, in accordance with Goldman Sachs Group Inc.

Article content material

(Bloomberg) — The European Central Financial institution is unlikely to step immediately into foreign-exchange markets even within the face of a greater than 10% droop within the euro this yr, though there’s potential for Japan to have interaction in that type of intervention if the yen continues to unravel, in accordance with Goldman Sachs Group Inc.

Article content material

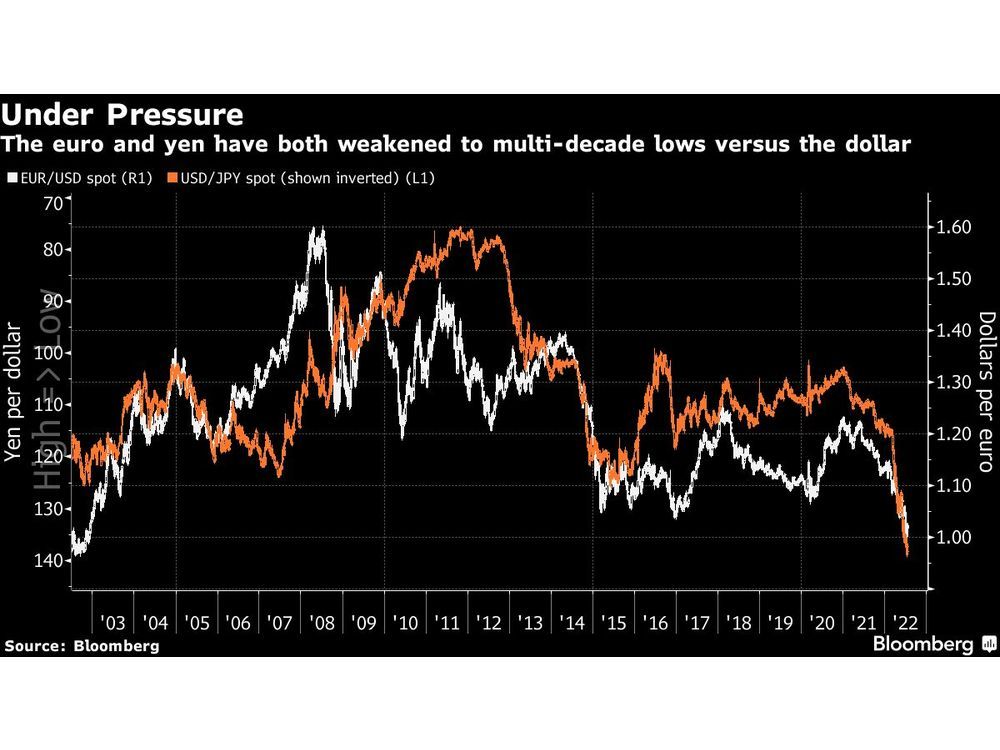

The US greenback, fueled by a mix of aggressive Federal Reserve financial coverage and haven shopping for, is buying and selling close to its strongest degree in a long time, steamrolling currencies from Hungary to New Zealand. The euro and yen — the dollar’s most generally traded friends — have struggled to carry their floor, whereas some nations reminiscent of Chile and India have already taken direct motion in assist of their currencies.

But the percentages such a transfer by the ECB within the near-term are low, in accordance with Goldman foreign-exchange strategist Karen Reichgott Fishman, who says President Christine Lagarde and her colleagues have extra urgent points to sort out earlier than shifting their consideration towards re-strengthening Europe’s frequent foreign money. Excessive on that record are the continuing surge in inflation, dangers to vitality provides, and the deterioration of so-called peripheral bond markets, like Italy’s, whose points are being exacerbated by ongoing political turmoil.

Article content material

These issues underpinned the financial institution’s choice earlier Thursday to carry its benchmark price by half a proportion level — its first improve in a decade — and supply additional particulars about its latest bond-market instrument, which is aimed toward stopping a splintering of the euro space.

It’s Sophisticated

“Issues of fragmentation dangers and elevated political uncertainty in Italy in the end outweighed the preliminary upward strain on the euro — highlighting the sophisticated set of challenges the only foreign money is dealing with in the mean time,” the Goldman strategist wrote in a report revealed Thursday. Whereas FX intervention is actually “within the toolkit” the chance of the ECB deploying it’s “low,” in her view.

In the meantime, the Japanese yen is down greater than 16% towards the dollar up to now this yr and earlier this month touched its weakest degree since 1998. Financial institution of Japan Governor Haruhiko Kuroda emphasised Thursday his dedication to stay with rock-bottom rates of interest even when it means a weaker yen.

But how lengthy the BOJ can stand pat as its foreign money plummets may be very a lot an open query nonetheless. Reichgott Fishman notes that whereas interventions by the world’s largest central banks have been uncommon in latest a long time — and once they do happen they’re sometimes co-ordinated amongst a number of financial authorities — the percentages that Japan would possibly do one thing will improve if the dollar-yen price pushes even increased.

[ad_2]

Source link