[ad_1]

Key Insights:

-

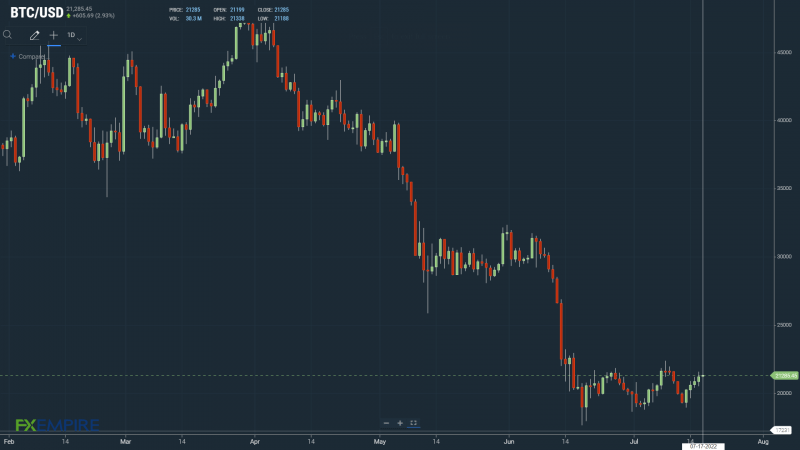

Bitcoin (BTC) rose by 1.79% on Saturday to increase its successful streak to 4 periods.

-

Market sentiment in direction of US retail gross sales figures and additional response to FOMC member chatter delivered assist.

-

The Bitcoin Worry & Greed Index elevated from 21/100 to 24/100, reflecting enhancing investor sentiment.

On Saturday, bitcoin (BTC) rose by 1.79%. Following a 1.21% acquire on Friday, BTC ended the day at $21,199. It was a fourth consecutive day within the inexperienced, with market sentiment in direction of Fed financial coverage delivering assist.

A bearish begin to the day noticed BTC fall to a low of $20,481 earlier than making a transfer.

Coming inside vary of the First Main Assist Stage at $20,405, BTC rallied to a excessive of $21,575.

BTC broke by the First Main Resistance Stage at $21,215 earlier than falling again to sub-$21,200. Regardless of the late pullback, BTC held onto the $21,000 deal with for the primary time since July 9.

With the US markets closed, FOMC member chatter from Friday and the upbeat US retail gross sales figures continued to ship assist.

Bitcoin Worry & Greed Index Inches towards the “Worry” Zone

Right this moment, the Worry & Greed Index elevated from 21/100 to 24/100. Matching the Index degree from July 9 and 10, the Index stood on the highest degree since Might 5 (27/100).

The newest transfer again in direction of the “Worry” zone, which begins at 25/100, got here off the again of a BTC return to $21,000.

The bulls will now search for a return to the “Worry” zone to assist a BTC run at $25,000.

Bitcoin (BTC) Value Motion

On the time of writing, BTC was up 0.41% to $21,285.

A uneven begin to the day noticed BTC fall to an early low of $21,188 earlier than rising to a excessive of $21,338.

Technical Indicators

BTC must keep away from the $21,086 pivot to focus on the First Main Resistance Stage (R1) at $21,689.

BTC would want a bullish session to assist a breakout from the Saturday excessive of $21,575.

An prolonged rally would take a look at the Second Main Resistance Stage (R2) at $22,180 and resistance at $25,000. The Third Main Resistance Stage (R3) sits at $23,273.

A fall by the pivot would carry the First Main Assist Stage (S1) at $20,595 into play.

Barring an prolonged sell-off, the Second Main Assist Stage (S2) at $19,992 ought to maintain BTC from a fall to sub-$19,500.

The Third Main Assist Stage (S3) sits at $18,897.

Wanting on the EMAs and the 4-hourly candlestick chart (under), it was a bullish sign. This morning, bitcoin sat above the 100-day EMA, presently at $20,644.

The 50-day EMA closed in on the 100-day EMA, with the 100-day EMA narrowed to the 200-day EMA; optimistic BTC indicators.

A bullish cross of the 50-day EMA by the 100-day EMA would carry $22,000 into play.

A maintain above the 100-day EMA and a breakout from R1 and the 200-day EMA, presently at $21,875, would goal R2.

On a pattern evaluation foundation, bitcoin would want a transfer by a Might 30 excessive of $32,503 to focus on the March 28 excessive of $48,192. Close to-term, resistance at $25,000 will possible be the primary take a look at ought to the upward pattern resume.

For the bears, the June 18 low of $17,601 could be the subsequent goal, with a fall by the present week low of $18,919 prone to take a look at investor resilience.

This text was initially posted on FX Empire

Extra From FXEMPIRE:

[ad_2]

Source link